Another hot topic in my home town of Montreal, Quebec, Canada concerning the ever seemingly uber expensive $/litre we pay gas to fill up our cars. Some ask why are we paying soo much more than before while the crude oil is soo low? Devil’s advocate speech is that the Loonie is soo depreciated against the Greenback, and that is what explains the higher gas prices at the pump, albeit the ultrea cheap crude oil quotes.

I gatherered some charts to proove OR dispell these theories.

Let’s look at today’s market:

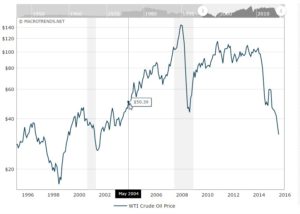

Crude oil is around 30 dollars USD.

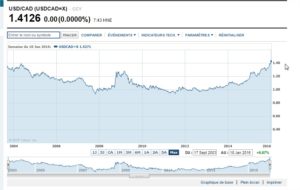

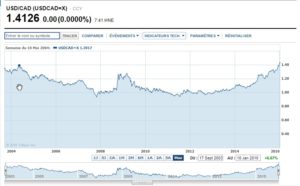

The value of the usdcad forex pair is around 1.42.

So that makes out to 42.82 CAD a barrel.

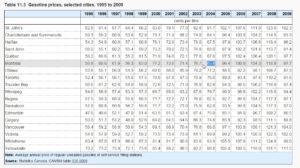

Today’s price at the pump for a litre of regular gasoline in Montreal is between 1.11 and 1.02 expressed in Canadian Dollars. I’ll take the middle of range for arguement’s sake (1.06).

So that is today’s ratio 42.82 a barrel for 1.06 a litre at the pump! (coefficient 40.39)

Let’s rewind circa May 2004:

The Crude Oil was 50.39 USD.

Usdcad for May 10th 2004 was 1.3917.

Giving a value of 70.12 CAD a barrel of oil.

Price at the pump for Montreal is set at 85.8 (average).

The ratio for May 2004 was 70.12 a barrel for 0.858 a litre at the pump! (coefficient 81.7).

Comparing the coefficients tells me we are getting TWICE AS LESS gas at the pump today than in 2004 for the same amount of disposable income!!!

Is there something I’m missing? My conclusion is we are definately paying too much for the gas at the pump IF the major factors are the combination of usdcad vs crude oil. Else, there is some un explained delta making the price at the pump that much more today than 12 years ago!